Why:

The current process of adding environmental tax against a part remains the same. However, when setup in the system, environmental tax can be added to an ‘external’ workshop order as a fixed amount at point of invoice.

Where:

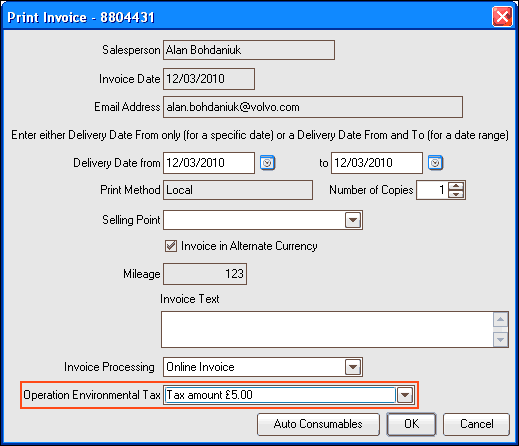

From the Control Master File view, select Operation Environment Tax. This will display the Operation Environment Tax window where the file can be setup. From the Workshop Order View, open the order that you would like to invoice and then select Order from the menu bar followed by Print > Proforma or Invoice. The Operation Environment Tax field will then be available as shown:

Operation Environmental Tax is only visible if:

1 - Parameter ETX004 = POS

2 - Any order lines in THF310 or THF311 match parameter VAL016 (External)

If the above are both valid then the first sequence number in the control file will be the default in the drop down list box, then the drop down list box will display descriptions in sequence order from this control file. Blank will also be a valid selection meaning no charge.

Operation number (parameter ETX005), description and amount based on the sequence number selected will be added to Proforma/Invoice/ credit (as the last line) based on details defined in this Control file. Account code and Tax code will come from THF025.

If an invoiced order is copied then environmental tax line will be removed from THF311, (check parameter ETX005) as it will be re-applied based on new selection at point of invoice.

If ETX004 is NEG then NO processing will take place and no drop down list will be displayed on Proforma or Print Invoice screen

If ETX004 = POS but no lines match VAL016 (i.e. all lines are internal or claim lines) then no Environmental tax drop down list box will be displayed.

Note! Where an Order is

split the environmental tax amount will be applied to each Customers

invoice.

Note! Where an Order is

split the environmental tax amount will be applied to each Customers

invoice.

What else would you like to do?

Related Topics:

Setup:

Create a new ‘Other’ local VST for environmental tax.

New Security ID 687 will need to be active to access

Control file

Create the required operation environmental tax records (file

THF698) as required with a description and amount.

Note! Lowest sequence

number will be the default in the Quotation/Proforma and Invoice print dialog

box.

Note! Lowest sequence

number will be the default in the Quotation/Proforma and Invoice print dialog

box.

Parameters:

Set parameter ETX004 to POS if environmental tax is to be added to a workshop order for external sales.

Add Local operation created to parameter ETX005