Why:

In some markets the customer is charged an invoice administration fee for each workshop or parts invoice raised. The purpose of the Invoice Charging function in GDS Fusion is to allow an invoice administration charge to be added automatically to parts and workshop orders and quotations.

The invoice administration charge defaults automatically onto new orders from an invoice charge code held on the customer file. The user is able to review and amend invoice charge and its tax on an order.

Where:

Invoice Charge Code Maintenance is in the Customer Category Control Files. Each charge code is given a description and charge amount.

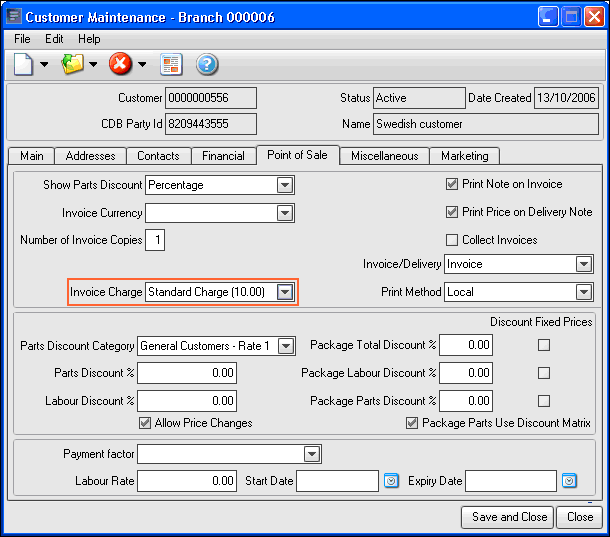

When parameter IFC001 is positive, invoice charge is displayed in customer maintenance, on the point of sale tab:

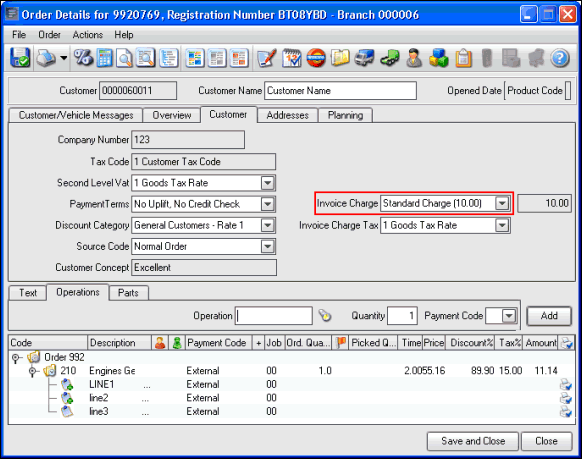

Invoice charge and invoice charge tax is included in the workshop order and quotation header on the customer tab:

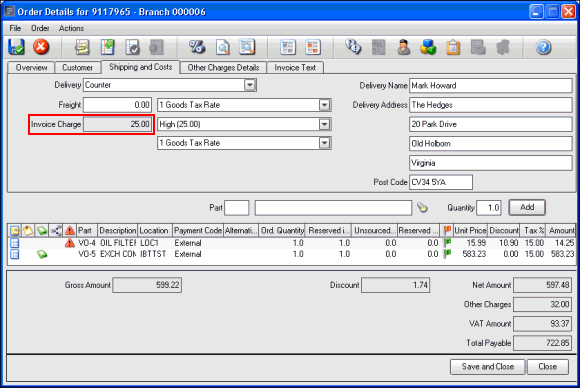

Invoice charge and invoice charge tax is included in the parts order and quotation header on the shipping and costs tab:

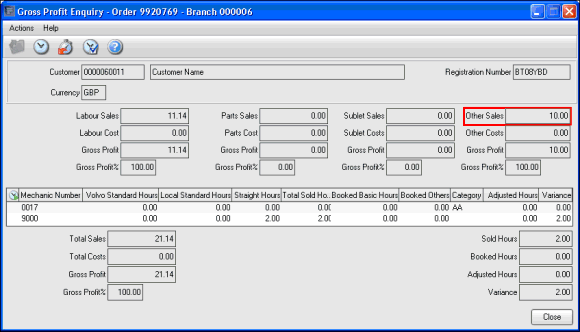

Workshop orders and quotations include the invoice charge amount in ‘Other Sales’ on the Gross Profit Enquiry screen:

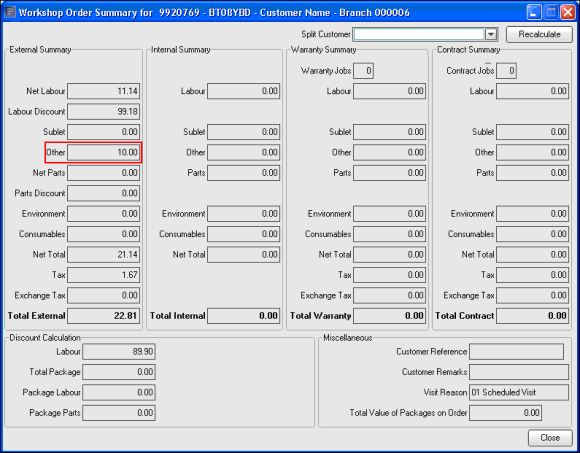

Invoice Charge amount is included in ‘Other Sales’ on the Workshop Order Summary screen:

Notes! Because invoice

charge is stored in the extra costs’ field on the order header, either Invoice

Charge or Extra costs are shown on a parts order. When the invoice charge

functionality is switched on extra costs cannot be used. When it is switched

off, the Invoice Charge field shown in the previous screenshots will change to

show the ‘Extra’ field instead.

Notes! Because invoice

charge is stored in the extra costs’ field on the order header, either Invoice

Charge or Extra costs are shown on a parts order. When the invoice charge

functionality is switched on extra costs cannot be used. When it is switched

off, the Invoice Charge field shown in the previous screenshots will change to

show the ‘Extra’ field instead.

Zero value orders and orders with only non-external lines (warranty or internal) do not include an automatic invoice charge.

If a credit note is created by copying a previous order (RMK > Customer Return in workshop or Full Credit of a parts order), the invoice charge from the order is copied to the credit note. A credit note raised by any other means (including Partial Credit of a parts order) does not include the invoice charge.

For Parts collect invoices, the invoice charge is only applied once for the collect invoice, even though it may include many orders. The charge applied to the first order processed is the one which is applied to the invoice.

If a workshop order is split between two or more customers, the invoice to the first customer, whose customer number is on the order header, has an invoice charge applied automatically. Subsequent invoices split to different customers, also have an invoice charge applied automatically using the default invoice charge which is defined on each respective customer file. Invoice charge for secondary customers cannot be amended or removed.

The customer invoice on an insurance order for any excess, betterment or tax payable by the customer, is created on the basis of the deal between the insurance company and the customer. If the order header holds an invoice charge it will be payable by the insurance company. The customer invoice will not include any separate invoice charge.

Parameters:

|

Parameter Name |

Purpose / Description |

|

CUS 018 |

The default Invoice Charge at customer creation. Default value = 0. Possible values 0 – 9 (1 alpha) |

|

IFC 001 |

Enable Invoice Charging. Default value = *LIKE(NEG001). Possible values *LIKE(POS001) / *LIKE(NEG001). |

|

MTD 001 |

The default value for zero cost invoice charge code used when order set to a cash payment type. As default this value is blank. Possible values are 0 – 9 (1 alpha). |

|

910 151 |

THF152 Key-Workshop Extra Charge. Default value = WXTRA. (7 alpha) |

|

910 152 |

FUTRAT Workshop: Extra Cost. Default value = WXTRA. (8 alpha) |

Related Topics: