Why:

It is possible to send WIP transactions for Parts to the General Ledger Interface. This will require a strategic decision being taken for each Dealer as it requires changes to the Accounts Interface files, THF150 & THF152.

Note! In an existing system

it would be wise to make sure that there are no existing Parts to WIP prior to

switching this functionality on. Also, any credit notes raised for prior

invoices will require a manual journal to correct any accounts. So it will

require strict control!

Note! In an existing system

it would be wise to make sure that there are no existing Parts to WIP prior to

switching this functionality on. Also, any credit notes raised for prior

invoices will require a manual journal to correct any accounts. So it will

require strict control!

For new markets it will depend entirely on the

prior system as to whether a manual journal will be required. This will require

thorough testing prior to going live, including through to the 3rd

Party Finance system, as changes may be required for the

extract.

Where:

The following postings can be

achieved in the Nominal Ledger:

When a Part is added to an order a

transaction is sent to THF151, the general ledger interface file: CR Stock, DB

WIP.

If a Part is deleted this transaction is reversed.

Note! Since an invoice

number does not exist at this point, only an order number will be written to the

THF151 file. There are no postings to the THF164 Invoice Journal File.

Note! Since an invoice

number does not exist at this point, only an order number will be written to the

THF151 file. There are no postings to the THF164 Invoice Journal File.

When an Invoice is completed the following postings can be achieved: CR Parts Sales, DB (Sales) Ledger Control, CR WIP, DB Parts Cost of Sales.

When a Credit is completed the following postings can be achieved: DB Parts Sales, CR (Sales) Ledger Control, DB Stock and CR Parts Cost of Sales.

How:

As far as 3rd party accounts interface is concerned, postings follow the current rules as far as timing is concerned. Therefore, if a posting for an add has already occurred and this is subsequently deleted and re-added, then only an amended posting will occur with any price difference.

To maintain integrity, if this option is switched on Parts will not be allowed to be amended at line level. In that case, the part should be deleted and re-added.

Reiterateing this function will require thorough testing setup prior to going live for any market thinking of using it, and cannot just be switched on whilst Users are logged on to the system. The test also has to include posting through to the 3rd party finance system, in case changes are required there.

Setup:

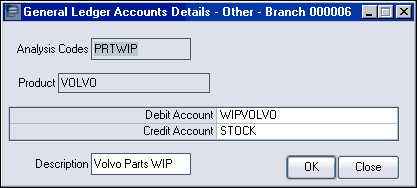

Parameter WIP 002 controls this functions. This requires Parameter 910 263 to be setup with an Analysis Code, e.g. PRTWIP and an entry in the THF General Ledger Other file. This can be by Branch & Product Code as necessary.

Parameter 910 264 also requires a FUTRAT description for THF151. e.g. WIPPARTS.

Note! Only the first two

digits of this are passed to Accounts interfaces as currently happens. So the

first two digits need to be recognisable for that purpose.

Note! Only the first two

digits of this are passed to Accounts interfaces as currently happens. So the

first two digits need to be recognisable for that purpose.

Parameter RES 002 controls when the transaction is passed. If set to negative, it is sent immediately as it is added, if set to positive, it is sent when the Picking List is printed.

Note! This is overwritten

in the following circumstances. Kit Parts transactions are only sent when the

Picking List option is ticked, and Package Parts transactions are only sent when

a Picking List is requested to confirm the parts.

Note! This is overwritten

in the following circumstances. Kit Parts transactions are only sent when the

Picking List option is ticked, and Package Parts transactions are only sent when

a Picking List is requested to confirm the parts.

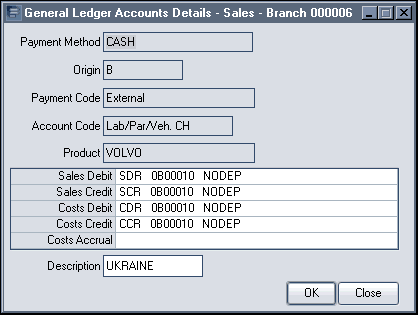

This requires the requisite entries in THF150 General Ledger Sales file for all Parts strings (both B & P), for when an invoice is completed in order that the correct postings can be achieved:

If a Credit note is produced, the WIP transaction does not take place, so only the relevant transactions are reversed. The pick action does not need to take place because once invoiced the WIP has already moved to COS. In order for this to happen the Cost Accrual account previously only used for Vehicle Administration purposes will be brought into use for the DB Stock Transaction, but only if WIP 002 is Positive.

So, if this is used, All Parts strings (both B & P) will require a value.

Note! This does not affect

the way that VA Cost Accrual works as they are S strings.

Note! This does not affect

the way that VA Cost Accrual works as they are S strings.